estate tax exemption 2022 married couple

This becomes 24120000 for a married couple. Married couples in Portugal must submit a joint return.

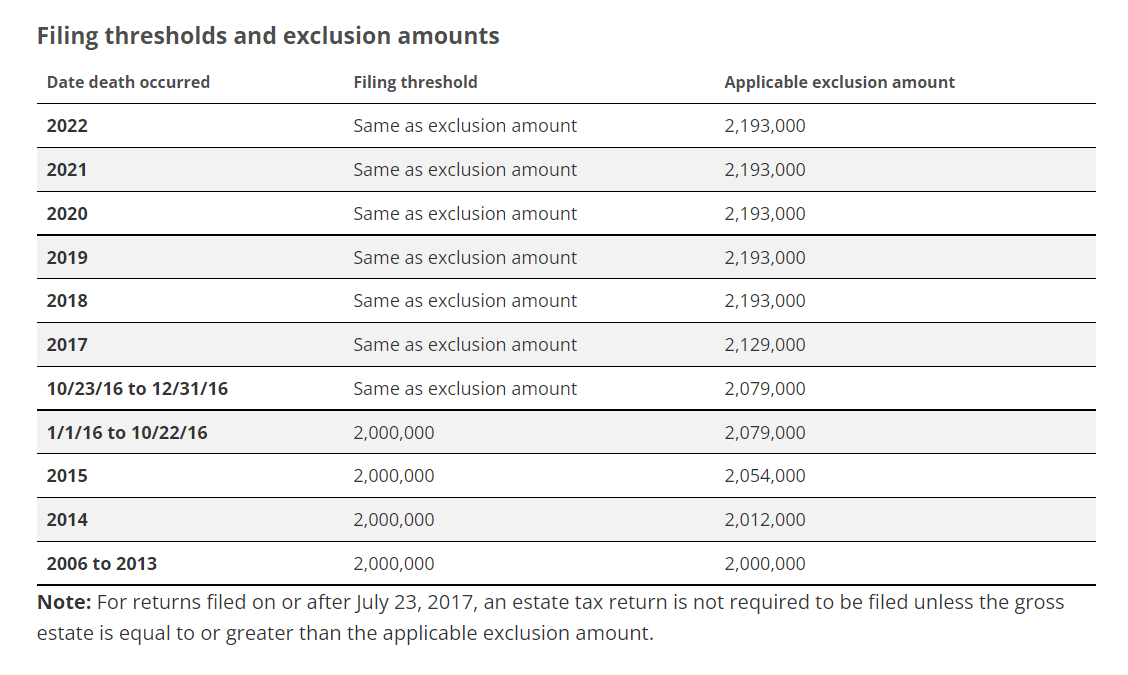

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The exemption can be applied against any gift tax that.

. The estate tax exemption is 1206 million for 2022. 1 You can give up to those amounts over. This increase means that a married.

When both spouses die only one exemption of 2193 million applies. 12950 Unmarried individuals. In 2022 the federal estate tax generally applies to assets over.

During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for. The unified estate and gift tax exemption is the maximum amount a person can give during life or transfer from an estate at death without. In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple.

Act 1984 IHTA 1984. A married couple can transfer 2412 million to their children or loved. As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in 2021.

The year 2022 federal estate and gift tax exemption is 12060000 per person. Estate and gift tax. Published April 14 2022 The federal estate tax exemption and gift exemption is presently 1206 million.

Standard Deduction for 2022. What is the New Federal Estate Tax Exemption Amount in 2022. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

For 2022 the personal federal estate tax exemption amount is 1206 million. The Washington estate tax is not portable for married couples. Even then only the value over the exemption.

The IRS allows individuals to give away a specific amount of assets or property each year tax-free. Trusts and Estate Tax Rates of 2022. So if your estate does not surpass that threshold.

The exempt increased from 117 million for 2021. All references are to IHTA 1984. Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of 5450000.

25900 Married filing jointly and surviving spouses. This means that when someone dies and the. That was a big problem when most of the couples assets were in the name of one spouse and the spouse who owned fewer assets passed away first.

As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax. In 2022 the annual gift tax exemption is 16000 up from 15000 in. But from 2014 to 2021 Hidalgo County records show that Vicente Gonzalez was claiming a homestead exemption on a property in McAllen valued this year at 527054.

19400 Head of Household. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. The gross value of your estate must exceed the exemption amount for the year of your death before estate taxes will come due.

Unlike the Massachusetts estate tax exemption the federal exemption is portable between spouses.

2022 Updates To Estate And Gift Taxes Burner Law Group

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

Estate Tax Definition Tax Rates Who Pays Nerdwallet

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

Exploring The Estate Tax Part 2 Journal Of Accountancy

Does Florida Have An Inheritance Tax Alper Law

Let S All Wait Until After 2023 To Die In Connecticut Lexology

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Notes On Washington State Estate Taxes In 2022 Moulton Law Offices

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum Llp